Phosphate segment – downstream

Performance

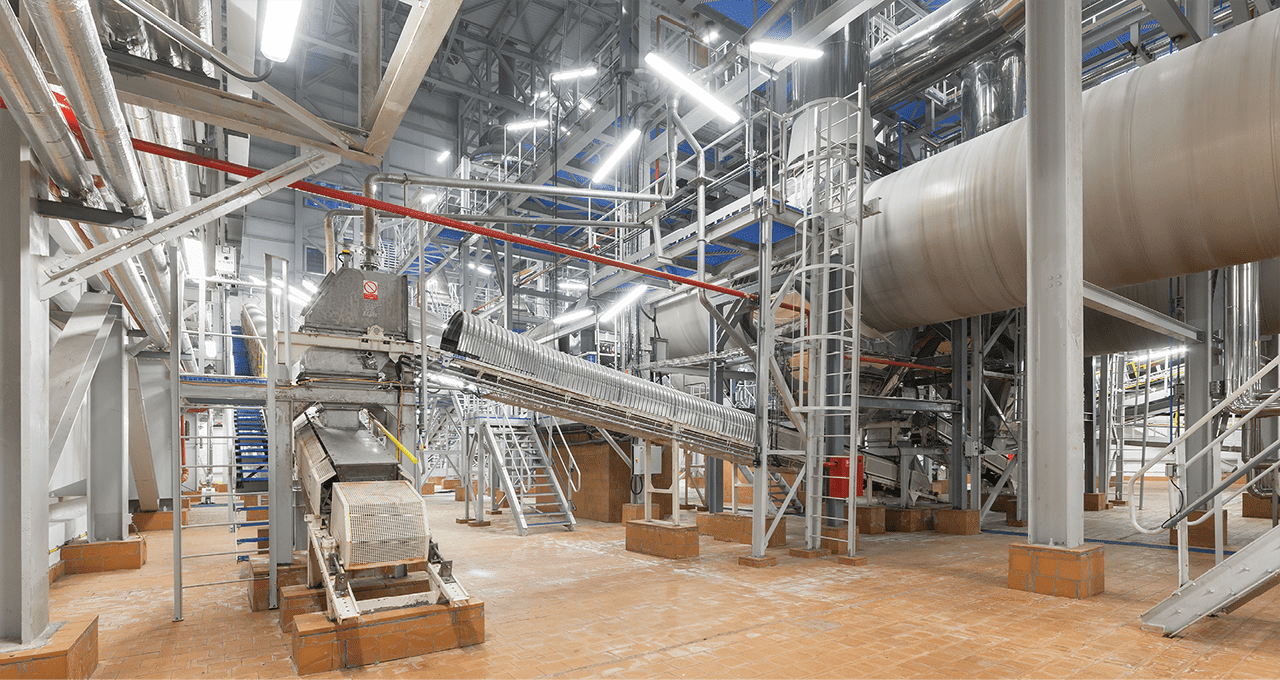

In 2019, PhosAgro’s output of phosphate-based fertilizers was up by 6.1% y-o-y to 7.3 mt. The growth was due to several factors. First, the completion of investment projects to modernise key production capacities in Cherepovets and Balakovo helped to boost the output of basic semi-finished products (sulphuric and phosphoric acid) and mineral fertilizers. Second, efforts to reduce the number of major overhauls and eliminate downtime, resulted in a significant increase in working time. Finally, production flexibility post modernisation helped expand the fertilizer range, among other things by adding less concentrated grades, and switch from one grade to another with virtually no downtime.

Sales of phosphate-based fertilizers went up by 9.4% y-o-y to 7.3 mt. The European market showed the strongest growth (+28.6%), with shipments to the CIS and Russia steadily trending upward, as well (+16.1% and +13.9%, respectively).

In 2019, we launched a project to build a modern facility for making phosphate-based fertilizers, and a power plant at Apatit’s Volkhov branch. Due in 2023, it will be financed from both the Company’s own resources and borrowed funds and is estimated to cost around RU

Outlook

We continue with our efforts to increase fertilizer production and enhance self-sufficiency in key feedstock to ensure sustainable growth and strengthen our cost leadership among global peers. We expect to benefit from the completion of several major investment projects that will allow us to increase self-sufficiency in key inputs and achieve sustainable cost savings in our upstream operations. These include a 1

As part of this effort, we plan to achieve a 100% self-sufficiency in phosphate rock, an 80% self-sufficiency in ammonia, and a 91% self-sufficiency in sulphuric acid.