Operational review

In 2019, PhosAgro continued its steady growth, delivering record high operating results on the back of previous investment cycle projects. With stable demand in our key markets, the Company was able to increase output across its production facilities, while a balanced approach to maintenance works helped offset the seasonality in end-product shipments. As a result, PhosAgro’s fertilizer production hit a record high of 9.5 mt, fully meeting our target.Mikhail Rybnikov First Deputy CEO of PhosAgro

In 2019, PhosAgro continued its steady growth, delivering record high operating results on the back of previous investment cycle projects. With stable demand in our key markets, the Company was able to increase output across its production facilities, while a balanced approach to maintenance works helped offset the seasonality in end-product shipments. As a result, PhosAgro’s fertilizer production hit a record high of 9.5 mt, fully meeting our target.Mikhail Rybnikov First Deputy CEO of PhosAgro

In 2019, fertilizer output increased by 6.1% vs a year ago. By moving some of the overhauls and renovations to the low-demand season for fertilizers, we managed to significantly ramp up production across our facilities. The modernisation of some sites in Cherepovets and Balakovo, completed in late 2018, also contributed to the output growth.

The rise in fertilizer production was supported by output growth in feedstock, including phosphate rock, ammonia, sulphuric and phosphoric acids. This helped us maintain self-sufficiency in key raw materials and secure a cost advantage for higher competitiveness in global markets.

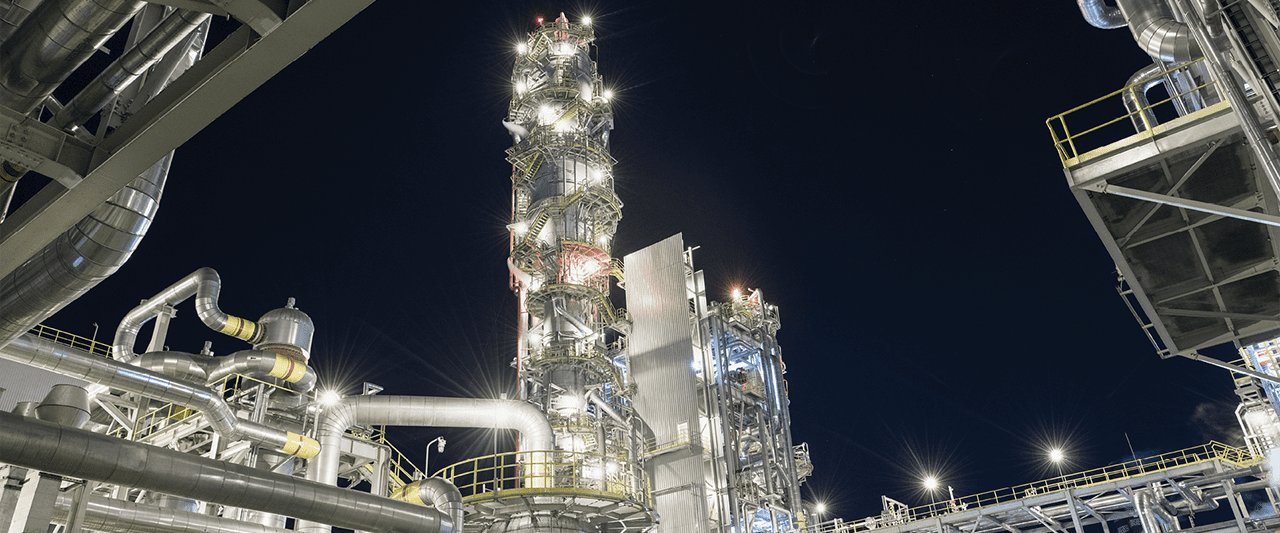

PhosAgro has been consistently increasing fertilizer output since it hit 6 mt in 2014. Over the six years, the Company has increased production by an impressive 59%. Today, PhosAgro manufactures more than 50 grades of mineral fertilizers for different soils and climates. PhosAgro’s business is based on high-performing assets. In Apatity, PhosAgro develops deposits of apatite-nepheline ore, unique for its high nutrient content and low content of potentially hazardous heavy metals, such as cadmium. Through investment in mining efficiency we steadily reduced our development and manufacturing costs, while the Company’s vertically-integrated structure ensured that our fertilizers had no heavy metals or other harmful impurities.

Our flexible sales policy helped us increase shipments to our priority markets in 2019. Sales in the Russian and CIS market rose by over 10%, exceeding

Overall, we were able to boost production, reduce costs, increase self-sufficiency in all feedstocks (ammonia, sulphuric acid, and ammonium sulphate), and bring down transportation costs. Beyond improving these essential quantitative indicators, we also registered major qualitative achievements by expanding our product range and, most importantly, boosting nutrient recovery.

In 2020, we plan to continue strengthening our position as a leading low-cost producer through our key investment projects. Leveraging the best available techniques to increase operational efficiency and reduce production costs remains our priority.